Are you looking to promote your tax services and stand out from the competition? If so, one effective marketing tool you should consider is tax services business cards. In a digital world, business cards may seem outdated, but they remain a powerful and essential tool for networking and leaving a lasting impression on potential clients. In this article, we will explore the importance of tax services business cards and provide some tips on how to create an effective and professional design.

The Importance of Tax Services Business Cards

In the world of accounting and tax services, building strong professional relationships is crucial for success. While online marketing and social media platforms can help reach a wider audience, nothing compares to the personal touch of exchanging business cards. Handing over a well-designed and informative business card creates a tangible connection that lingers in the minds of potential clients.

1. Business Cards Create a Lasting Impression

When attending networking events or meeting new clients, business cards serve as an instant reminder of your services. A well-designed business card can leave a positive and lasting impression, making it more likely that potential clients will reach out to you when they are in need of tax services.

2. Business Cards Showcase Professionalism

Tax services business cards demonstrate professionalism and convey trustworthiness. When providing individuals or companies with your contact information on a well-designed card, you showcase your attention to detail and commitment to professionalism. This can significantly impact how potential clients perceive your services.

3. Business Cards Facilitate Networking Opportunities

Attending industry conferences or networking events is an ideal opportunity to expand your professional network. However, relying solely on memory to recall contacts can be challenging. With business cards, both you and your potential clients can easily exchange contact information, ensuring that valuable connections are not lost.

4. Business Cards Act as a Referral Tool

Even if a potential client does not need tax services themselves, they may know someone who does. By providing them with your business card, they become equipped to refer your services to others. Business cards serve as a compact and convenient way for satisfied clients to pass on your information and refer new clients to your accounting business.

Designing an Effective Tax Services Business Card

Now that you understand the importance of tax services business cards, it’s crucial to ensure your design effectively conveys your professionalism and expertise. Here are some key elements to consider when creating your business card:

1. Choose a Professional Design

First impressions matter, so invest in a professional design for your tax services business card. Choose a clean and straightforward layout that reflects your brand identity. Avoid cluttering the card with excessive information and opt for a design that complements your accounting business.

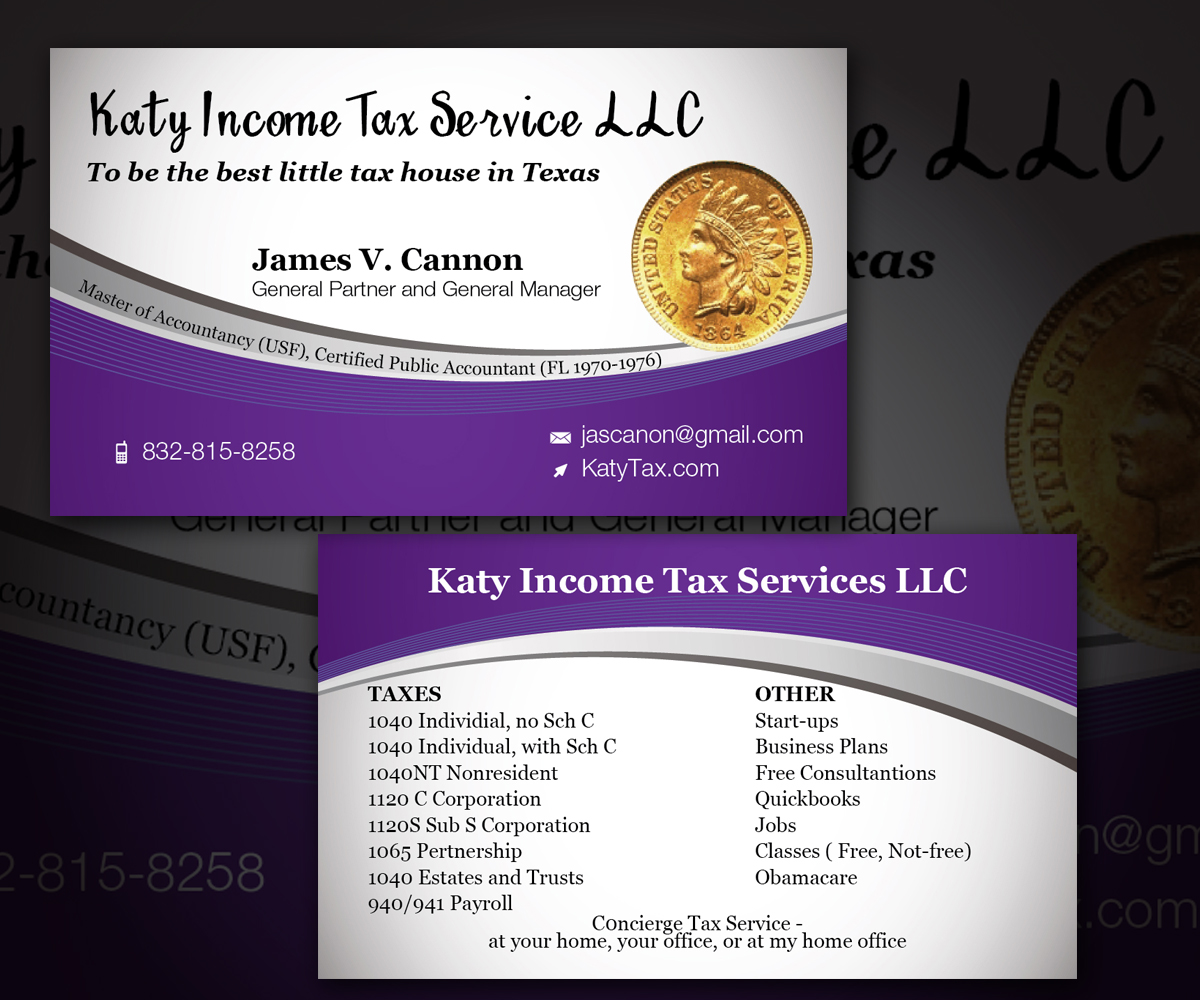

2. Emphasize Key Information

Include essential details on your business card, such as your name, job title, contact information, and company logo. Be selective about the information you include, ensuring that it is relevant and easily readable. Consider using both sides of the card to provide additional information or showcase your areas of expertise.

3. Incorporate Relevant Colors and Imagery

Choose colors that align with your brand’s visual identity and convey professionalism. Consider using your company’s logo colors to maintain consistency. Additionally, if your accounting business specializes in tax services for specific industries, such as real estate or healthcare, incorporating subtle imagery related to these industries can help establish your expertise.

4. Use High-Quality Printing

Investing in high-quality printing is crucial to ensuring your business cards look professional and durable. Opt for a sturdy cardstock or even consider adding finishing touches such as embossing or foiling to make your card stand out further.

5. Include a Call to Action

Encourage potential clients to take action by including a call to action on your business card. This can be something as simple as directing them to your website or offering a free consultation. Including a call to action can prompt people to engage with your services and take the next step towards hiring you as their trusted tax advisor.

Conclusion

Tax services business cards remain a valuable marketing tool for accounting professionals. By creating a professional and informative design, you can leave a lasting impression on potential clients, showcase your expertise, and facilitate networking opportunities. Remember to choose a professional design, emphasize key information, incorporate relevant colors and imagery, use high-quality printing, and include a call to action. Implement these tips, and your tax services business cards will become an invaluable asset to grow your accounting business and attract new clients.

Ava Taylor’s passion for branding and marketing shines through in her dynamic writing. She brings a unique perspective with her background in event planning, infusing creativity into her content. When she’s not writing, Ava enjoys organizing community events and gatherings.