If you’re a healthcare provider or insurance agent, you know how important it is to have a professional image. One way to achieve this is by using Medicare business cards. These cards are specifically designed to help you market your services to Medicare beneficiaries and make it easy for them to contact you.

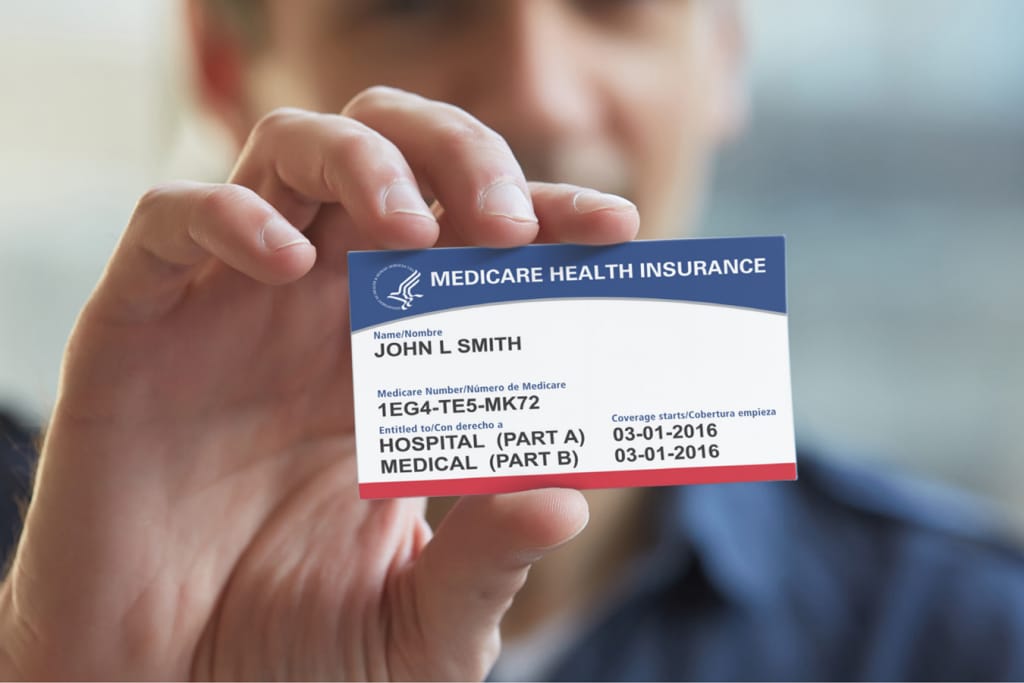

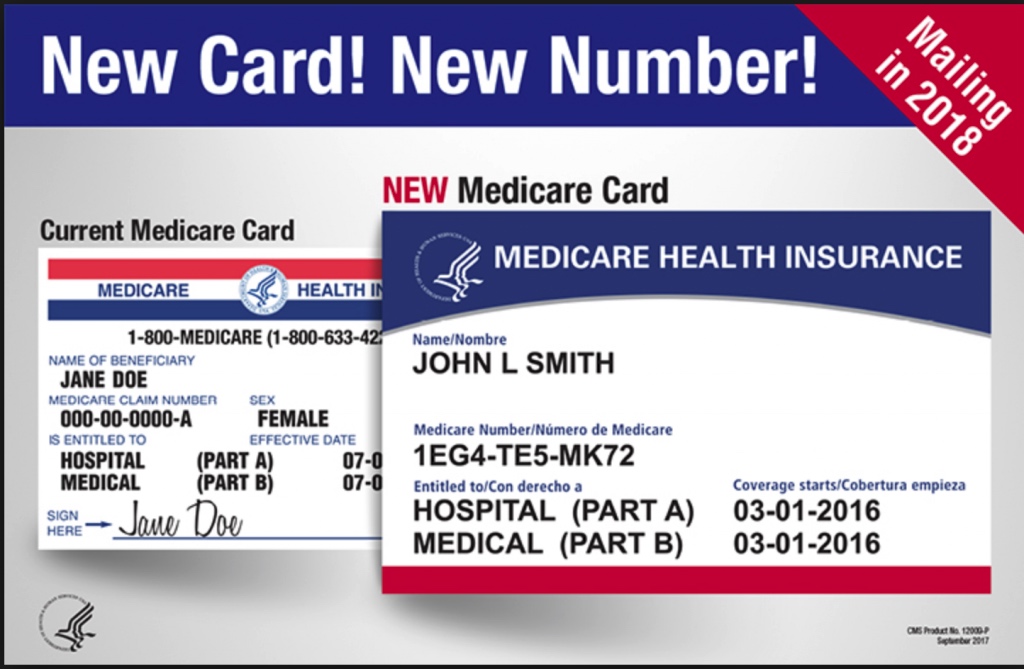

Medicare business cards come in a variety of designs and styles, so you can choose one that fits your brand and personality. Some cards feature medical images or symbols, while others have a more traditional look. You can also customize your cards with your name, contact information, and any other details you want to include. Whether you’re meeting with clients in person or sending out mailers, having a professional-looking business card can help you stand out and make a great first impression.

Understanding Medicare Business Cards

If you are a licensed Medicare professional or market Medicare Advantage plans, you may want to consider using Medicare business cards. These cards can help you promote your business and provide potential clients with your contact information.

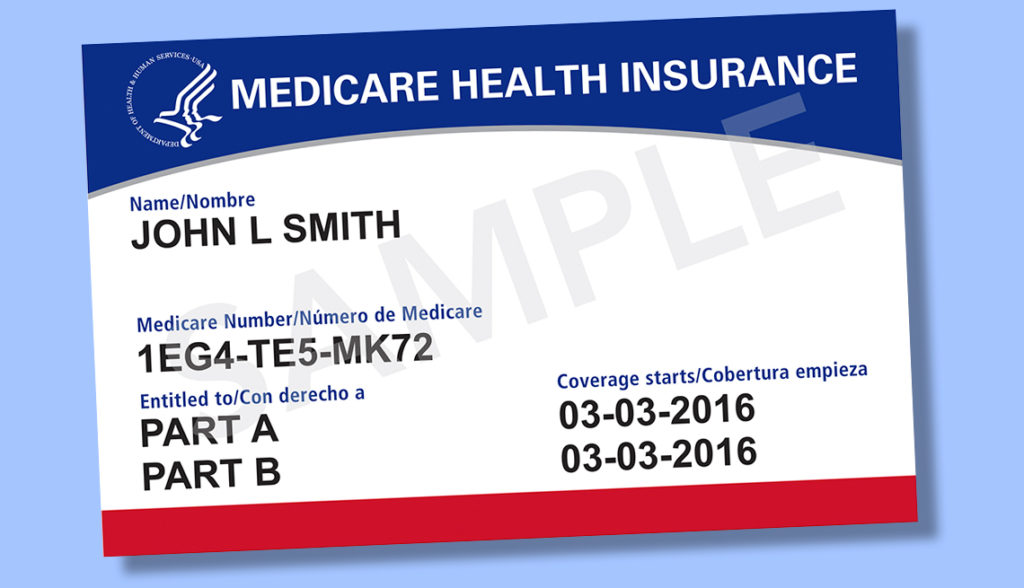

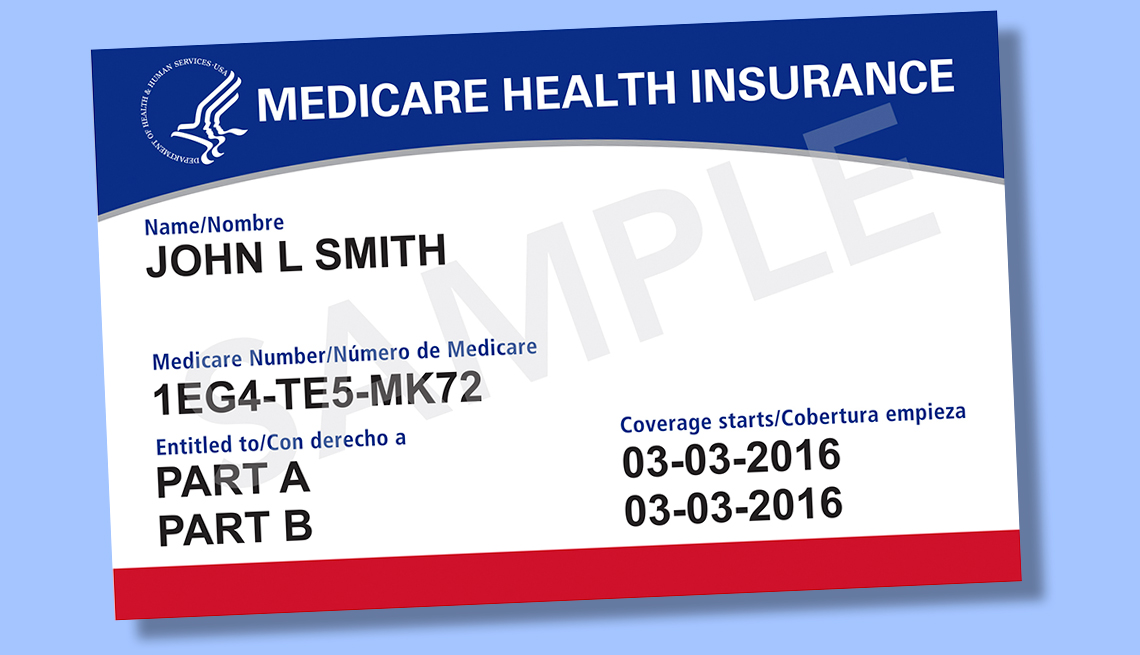

A Medicare business card typically includes your name, business name, contact information, and any relevant design or branding elements. Some professionals may choose to include their license number or other certifications on the card as well.

When designing your Medicare business card, it is important to ensure that it complies with all applicable regulations and guidelines. This includes any branding or design elements that may be subject to approval by Medicare or other regulatory bodies.

Using a professional and well-designed Medicare business card can help you make a positive impression on potential clients and build trust in your services. It can also make it easier for clients to contact you if they have any questions or concerns about their Medicare coverage.

Overall, if you are a licensed Medicare professional or market Medicare Advantage plans, a Medicare business card can be a useful tool in promoting your business and building your client base. Just be sure to follow all applicable regulations and guidelines when designing and distributing your cards.

Compliance and Regulations

When it comes to marketing your Medicare services, it is important to remain compliant with the regulations set forth by the Centers for Medicare & Medicaid Services (CMS) and other governing bodies. Failure to comply can result in penalties and damage to your reputation.

The CMS has issued marketing rules for Medicare Advantage plans (MAPs) and Medicare Part D plans (PDPs) in order to protect consumers and ensure fair competition. These rules cover a range of topics, including advertising, enrollment, and sales practices.

To ensure compliance with CMS marketing rules, it is important to understand the Medicare Marketing Guidelines. These guidelines provide detailed information on how to market Medicare services in a compliant manner. They cover topics such as branding, advertising, and communication with beneficiaries.

In addition to the CMS rules, it is important to be aware of the Federal Trade Commission’s (FTC) regulations regarding marketing and advertising. These regulations are designed to protect consumers from false or misleading advertising and apply to all industries, including healthcare.

Overall, maintaining compliance with Medicare marketing regulations is crucial for the success of your business. By following the guidelines set forth by CMS and other governing bodies, you can ensure that your marketing efforts are ethical, transparent, and effective.

Effective Marketing Strategies for Medicare Business Cards

When it comes to marketing your Medicare business, business cards are a simple and effective tool that can help you reach potential clients. Here are some effective marketing strategies for Medicare business cards:

1. Make Your Business Cards Stand Out

Your business cards should be eye-catching and professional. Use bold colors, high-quality paper, and clear fonts to make your business cards stand out. You can also include your photo on your business card to help potential clients remember you.

2. Include All Relevant Information

Make sure your business cards include all relevant information, including your name, phone number, email address, website, and any social media profiles you have. You should also include your plan name and any disclaimers that are required by law.

3. Use Your Business Cards in Your Marketing Materials

Include your business cards in all of your marketing materials, including flyers, direct mail marketing, and advertisements. You can also hand out your business cards at events and conferences to generate leads.

4. Use Your Business Cards to Retain Clients

Business cards are not just for generating new leads, they can also be used to retain clients. Include a special offer or discount on your business card to encourage clients to stay with you. You can also use your business cards to remind clients of upcoming AEP deadlines.

5. Be Mindful of Uninvited Sales Agents

Be mindful of uninvited sales agents who may try to use your business cards to sell their own products. Make sure your business cards clearly state that you are a licensed Medicare broker, and that you only sell the plans you represent.

By following these effective marketing strategies, you can use your Medicare business cards to generate leads, retain clients, and grow your business.

Financial Considerations and Ethical Practices

When it comes to Medicare business cards, there are several financial considerations and ethical practices that you should keep in mind. Here are some important things to consider:

1. Insurance Companies and Carriers

When choosing a Medicare plan, it’s important to research and compare different insurance companies and carriers. Make sure to read the fine print and understand the terms and conditions of each plan before making a decision. Some plans may have restrictions or limitations on certain services, so it’s important to choose a plan that meets your specific needs.

2. Part D and Health Insurance

Part D is a prescription drug coverage plan that is offered by Medicare. If you are enrolled in Part D, you can choose a plan that covers the medications you need at an affordable cost. It’s important to review your plan each year during the open enrollment period to ensure that it still meets your needs.

3. Social Security and Personal Information

Medicare is administered by the Social Security Administration, so it’s important to keep your personal information up to date with them. This includes your name, address, and Social Security number. Be cautious about giving out your personal information to anyone who claims to be from Medicare or Social Security, as this could be a scam.

4. Medicare Advantage Plans and Part B

Medicare Advantage plans are offered by private insurance companies and provide additional benefits beyond what is covered by Original Medicare. If you choose a Medicare Advantage plan, you will still need to pay your Part B premium. It’s important to understand the costs and benefits of each plan before making a decision.

5. Independent Agents and Guarantees

Independent agents can help you navigate the complex world of Medicare and find a plan that meets your needs. However, be cautious of agents who make exaggerated or false claims or pressure you into making a decision. Remember, there are no guarantees when it comes to insurance, so it’s important to do your research and choose a plan that meets your specific needs.

In summary, choosing a Medicare plan involves careful consideration of several financial and ethical factors. By doing your research, understanding your options, and working with reputable agents and carriers, you can find a plan that meets your needs and provides the coverage you need to stay healthy and happy.

Oliver dives into graphic design, branding, and marketing with passion. Beyond pixels and paper, he’s into boxing, CrossFit, and all things fitness. Oliver’s writing reflects his expertise and dedication to staying on top of industry trends.