Are you feeling overwhelmed by high-interest rates and multiple credit card bills? Juggling several credit cards can be a hassle, not to mention the financial strain it can place on your business. But fear not, because there is a solution that can make your life easier and help you save money – business cards balance transfer. In this article, we will delve into everything you need to know about utilizing balance transfers for your business cards.

What is a Business Card Balance Transfer?

A business card balance transfer refers to the process of moving the outstanding balance from one credit card to another. By doing so, you are essentially consolidating your credit card debt into a single card, usually with a lower interest rate. This can potentially save you a significant amount of money on interest charges, allowing you to pay off your debt more efficiently.

How Does a Balance Transfer Work?

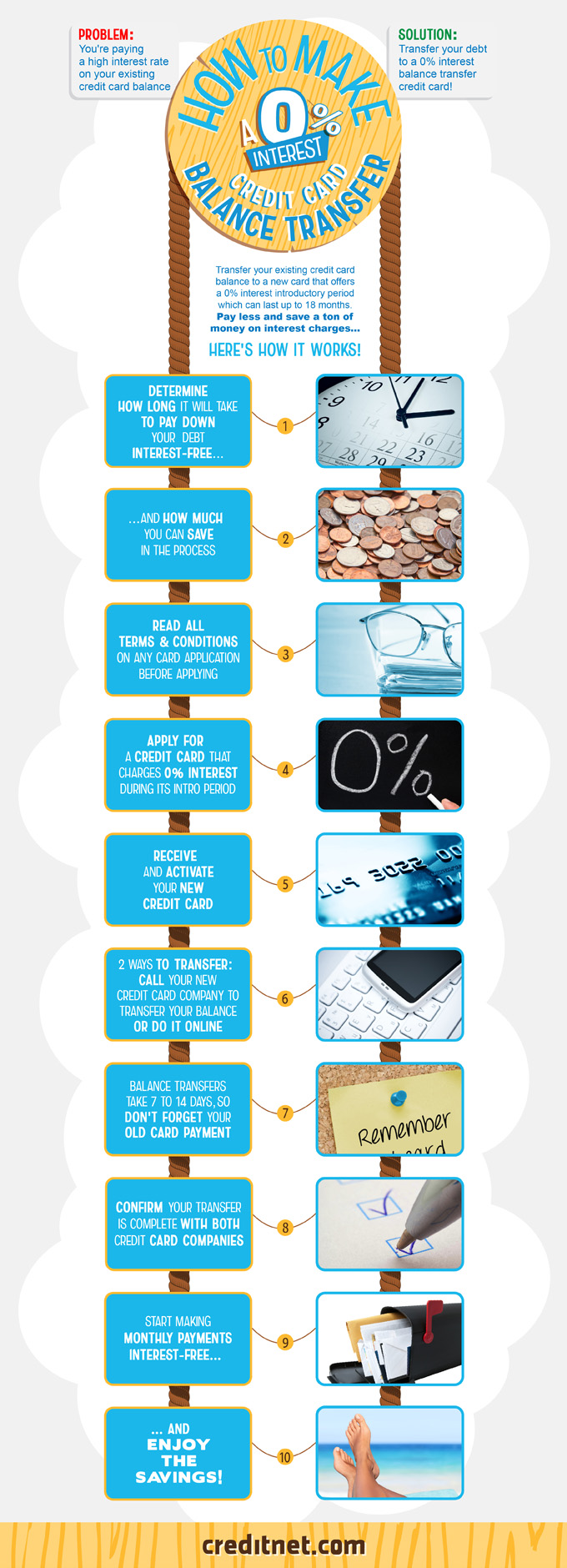

To initiate a balance transfer, you typically need to apply for a new credit card that offers this service. Once approved, you can choose to transfer your existing business card balances to the new card. Most credit card companies allow you to transfer balances from multiple credit cards, enabling you to consolidate all your debts under one account.

Once the transfer is complete, you will start making payments on the new credit card. Ideally, you should aim to pay off the balance within the promotional period offered by the new card. This promotional period usually comes with a lower or even zero percent interest rate, giving you the opportunity to save money on interest charges.

Benefits of Business Card Balance Transfer

1. Lower Interest Rates

One of the primary benefits of a business card balance transfer is the opportunity to secure a lower interest rate. If you’re currently paying a high interest rate on your business card balances, transferring those balances to a new card with a lower rate can significantly reduce your overall interest charges.

2. Debt Consolidation

Managing multiple credit cards can quickly become overwhelming. With a balance transfer, you can consolidate your debts into one single payment. This not only simplifies your financial life but also helps you stay organized and on top of your payments. It’s much easier to focus on paying off a single card rather than dealing with multiple cards with different due dates.

3. Save Money

By reducing your interest charges, a balance transfer can also help you save money in the long run. The money you save on interest can be put toward paying off your outstanding balance faster, allowing you to become debt-free sooner.

4. Streamlined Payments

Consolidating your balances through a balance transfer can streamline your payment process. Instead of dealing with multiple credit card statements and payment schedules, you only need to make payments to one credit card company. This can help you avoid late fees and ensure your payments are made on time.

5. Potential Rewards and Benefits

When selecting a new credit card for a balance transfer, consider one that offers rewards or benefits that align with your business needs. Some credit cards offer cashback, travel rewards, or other perks that can provide additional value to your business.

Things to Consider Before Initiating a Balance Transfer

While a business card balance transfer can be advantageous, there are some factors you should consider before taking the plunge:

1. Balance Transfer Fees

Most credit card companies charge a balance transfer fee, typically around 3% to 5% of the transferred amount. It’s essential to factor in this fee when determining whether a balance transfer is a cost-effective option for your business.

2. Promotional Period Length

The promotional period, during which you enjoy a lower or zero percent interest rate, varies between credit cards. Make sure to choose a card that offers a reasonable promotional period, allowing you enough time to pay off the balance without incurring high interest charges.

3. Eligibility and Credit Worthiness

To qualify for a new credit card and a balance transfer, you need to meet certain eligibility criteria. These criteria may include a good credit score, a specific income threshold, or other factors determined by the credit card company. Additionally, submitting multiple credit card applications in a short period can impact your credit score, so it’s important to be cautious.

4. Discipline and Repayment Strategy

Before initiating a balance transfer, it’s essential to evaluate your financial discipline and repayment strategy. The goal of a balance transfer is to pay off your debt efficiently. However, if you simply transfer the balances without changing your spending habits, you may find yourself in an even deeper financial hole. It’s crucial to have a plan in place to prevent accumulating more debt.

Conclusion

If you’re burdened with high-interest credit card debt from multiple cards, a business card balance transfer can be a game-changer. Consolidating your debts into a single card with a lower interest rate can save you money, simplify your payments, and help you become debt-free faster. However, it’s important to consider the balance transfer fees, the length of the promotional period, and your eligibility before proceeding. With a well-thought-out plan and disciplined financial behavior, a business card balance transfer can be the key to regaining control of your business finances.

Isabella, a branding guru, merges her love for storytelling with her marketing expertise. Her fascination with cultural diversity and travel lends a global perspective to her writing about business cards and graphic design. In her free time, she explores new cuisines and documents her culinary adventures.